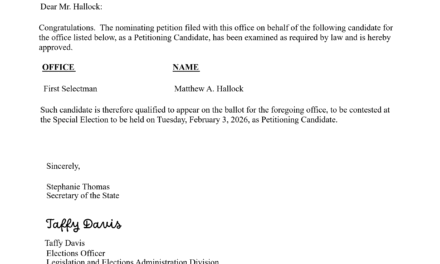

Last Updated on May 20, 2025 by Matthew Hallock

If the U.S. Treasury doesn't prosecute bad actors, will CT follow suit?

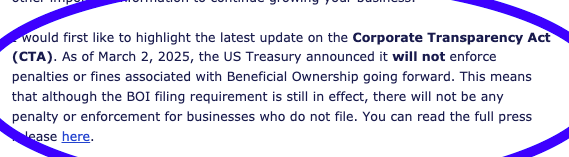

Treasury Department Announces Suspension of Enforcement of Corporate Transparency Act Against U.S. Citizens and Domestic Reporting Companies

This was the headline of the press release issued by the U.S. Treasury, clearly stating that they will not prosecute or penalitze entities that hide their officers and ownership. In the the cover email to its March business newsletter, the CT’s Secretary of State’s office included a blurb about it. This release is referring to the practice of using shell companies and hidden officers of LLCs to form real estate entities, particularly to launder and move money around the world. This is a massive practice that CT is not immune to.

The Shadow of Dark Money LLCs: How Hidden Wealth Shapes Our World

When you hear the phrase “dark money LLCs,” it might sound like something out of a spy novel. But these secretive entities are very real, and their influence reaches deep into politics, real estate, and beyond. They thrive in obscurity, moving money behind closed doors while the rest of us are left in the dark. It’s time to shed some light on these forces shaping our society.

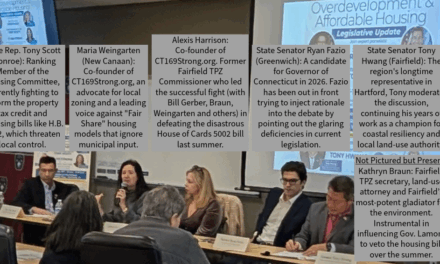

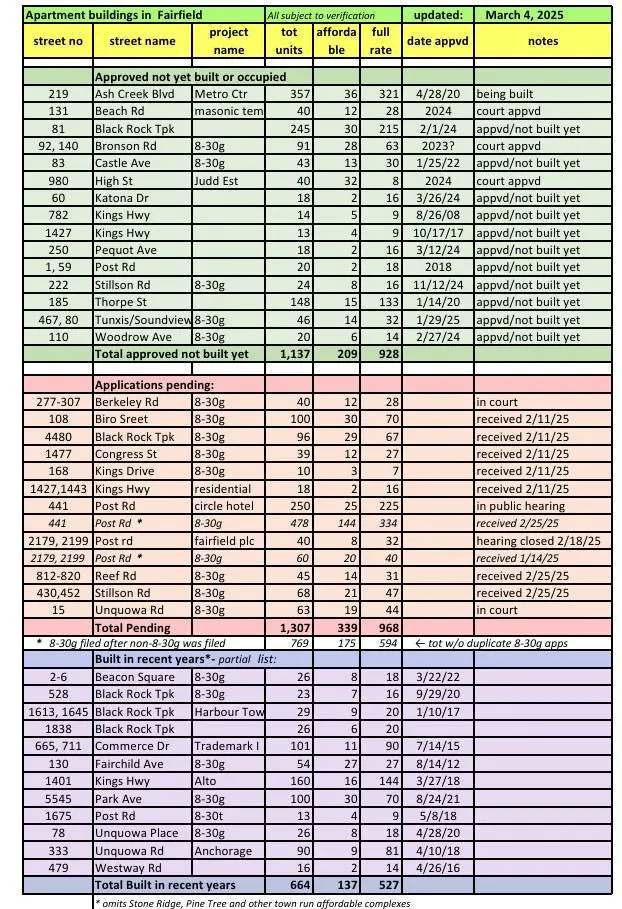

Fairfield has 40 high-density projects in various stages of approval. Currently, it does not know the LLC’s members, financing, or insurance status of many of them.Â

Â

Â

What Are Dark Money LLCs?

At their core, dark money LLCs are limited liability companies designed to obscure the identity of the people or organizations funneling money through them. Think of them as untraceable envelopes filled with cash pushed across a table. The money could be coming from corporations, wealthy donors, or even foreign interests. By design, LLCs can hide who’s really behind the curtain, making it incredibly difficult to know whose interests are being served.

This murkiness is appealing to those looking to influence elections, purchase real estate anonymously, or finance causes without public scrutiny. Worse, the lack of transparency means no accountability. These entities don’t have to explain where the money comes from or where it’s going.

The Political Power of Hidden Cash

If democracy is a conversation between the people and their leaders, dark money LLCs are the loudspeaker drowning us out. They allow massive sums of money to flood political campaigns without the public knowing who is pulling the strings.

Here’s how it often works in politics. A wealthy donor wants to support a political candidate or run attack ads against another. Instead of donating directly, where their name would show up on public records, they route the money through an LLC first. Bingo. The money gets spent, but the donor remains anonymous. Meanwhile, candidates supported by these funds can deny any direct connection to their shadowy backers.

The 2010 Supreme Court ruling in Citizens United v. FEC cracked the door wide open for unlimited political spending. But dark money LLCs kicked that door off its hinges. Outside groups like super PACs can receive unlimited contributions, and when those funds are funneled through LLCs, the source of the money becomes almost impossible to trace. The chilling result? Elections influenced by faceless funders with unknown motives.

Real Estate’s Dirty Secret

Dark money LLCs don’t just disrupt politics; they’ve got their claws in our neighborhoods, too. Imagine this scenario. An LLC swoops in and buys a block of properties in your city. Who owns these homes? Who’s profiting from them? Nobody knows. These LLCs gobble up real estate, sometimes leaving buildings abandoned or artificially inflating housing markets, pricing out regular people.

Take New York City, for example. Investigative reports have revealed shady LLCs snapping up luxury properties, many of which sit vacant as their owners, hidden behind layers of anonymity, wait for values to climb. This practice pushes up housing prices, making it harder for families to afford a place to live. Worse still, many LLCs have been linked to global money laundering operations, using high-value real estate to clean dirty cash.

These transactions erode trust in the market and throw up roadblocks for local governments hoping to enforce housing laws or collect taxes. After all, it’s tough to regulate what you can’t see.

The Challenges We Face

The problem with dark money LLCs isn’t just their existence. It’s the protection system allowing them to thrive. Current laws in many states protect the privacy of LLC owners, and while privacy in business is important, it shouldn’t come at the cost of public trust or fairness.

Fairield, CT, sees first-hand the scourge of dark-money LLCs, where large sums of money for projects are advanced without knowledge of who is behind it. Look at all the developments in various stages of approval. For many of them, the public does not know the owners or financing.

States like Delaware, Nevada, and Wyoming are especially well-known for being havens of anonymity. Their laws welcome anyone looking to create an LLC with little-to-no disclosure of ownership. This creates a loophole that’s exploited not just by campaign donors or real estate players but also by bad actors like drug traffickers and organized crime families.

The complexity of unraveling these webs is compounded by underfunded and understaffed agencies tasked with overseeing these systems. Regulators are often playing a losing game of catch-up.

Shining a Light on the Shadows

Here’s the good news—we can fix this. It takes political will and a demand from the public for greater transparency.

- Stronger Disclosure Laws

Some states have already taken positive steps. For example, laws requiring LLCs to disclose their “beneficial owners†(the real people behind the company) are gaining traction. The federal Corporate Transparency Act, passed in 2020, requires certain LLCs to report ownership information to the U.S. Treasury’s Financial Crimes Enforcement Network. But now the U.S. government has announced they are suspending enforcement. - Greater Enforcement

Laws are only as good as the ability to enforce them. Agencies overseeing campaign finance, real estate, and business regulations need proper funding and tools to monitor and investigate suspicious activities. - Public Awareness

The first step toward change is getting more people to care. If we understand how dark money LLCs affect our politics, housing, and communities, we can demand accountability. Let’s stop treating this issue like an insider’s game. The more light we shine, the harder it becomes for bad actors to hide in the shadows. - Closing Political Loopholes

Limit the amount of money that LLCs can donate to campaigns or causes. Elections should be about voices, not wads of cash. Restoring limits and transparency in campaign finance would go a long way towards leveling the playing field.

Fairfield deserves better. You deserve better.

We shoud have trust and expect honesty. And in the age of google, we have transparency. When we know what’s happening, we can push for laws that protect real people, not hidden bank accounts. Talk to your neighbors or your local representatives. Ask the hard questions.

Who owns the house next door? Who’s paying for those attack ads? Who is really funding your candidate’s campaign?

Change won’t come overnight. But imagine a world where big money doesn’t drown out your voice. A world where campaign donations are honest and housing markets are fairer. A world where trust, not secrecy, defines how we do business.

That world isn’t just possible. It’s necessary. And it’s worth fighting for.